Donate Pacific Palisades Real Estate

Turning Loss into Hope: Donating Fire-Damaged Property in Pacific Palisades

The recent wildfires in Pacific Palisades have left a profound impact on the community, displacing families, damaging homes, businesses, and land, and leaving many grappling with unimaginable loss. To those affected, we extend our heartfelt condolences during this challenging time. While recovery may feel overwhelming, donating fire-damaged property to organizations like us can provide a path forward that lightens your burden while helping rebuild lives.

Unburdening from Fire-Damaged Property

Owning fire-damaged property can be both emotionally taxing and financially draining. The cost of repairs may be prohibitive, and selling such property often presents challenges due to reduced market value. However, donation offers a practical alternative—one that not only relieves you of the responsibilities of ownership but also supports community recovery efforts.

By donating fire-damaged homes, businesses, or land to Giving Center, a trusted nonprofit organization, you ensure that these properties can be repurposed or restored for vital uses such as housing, environmental restoration, or community projects.

Understanding the Tax Benefits

Donating fire-damaged property can bring financial relief through significant tax advantages:

Charitable Tax Deductions: Property owners can deduct the fair market value of their donation, even if the property has been damaged. This deduction directly reduces taxable income, providing meaningful financial savings.

Capital Gains Tax Savings: If your property appreciated before the fire, selling it may result in high capital gains taxes. By donating, you avoid this liability entirely, maximizing the value of your contribution.

Elimination of Maintenance Costs: Fire-damaged property often incurs ongoing costs such as property taxes, insurance, and maintenance. Donating eliminates these expenses, providing immediate relief.

How to Donate Your Property

Property Assessment: Work with a certified appraiser to determine the fair market value of your property in its current condition. This valuation is essential for claiming tax deductions.

Choose a Qualified Charity: Organizations like Giving Center specialize in accepting fire-damaged properties and repurposing them for community benefit. As a 501(c)(3) nonprofit, Giving Center ensures your donation qualifies for tax benefits. Call (888)-228-7320 to discuss how we can help you donate your unwanted property today.

Transfer Ownership: Collaborate with Giving Center to complete the necessary legal steps for transferring ownership. This process is straightforward and guided by experienced professionals.

Claim Your Tax Deduction: Retain the appraiser’s report and submit IRS Form 8283 with your tax return to claim your deduction.

Supporting Pacific Palisades’ Recovery

The fires have profoundly affected Pacific Palisades, damaging homes, businesses, and open land. By donating your fire-damaged property, you can play a pivotal role in the area’s recovery. Giving Center works to transform such properties into resources for rebuilding and renewal, helping both individuals and the broader community heal.

Real-Life Impact: A Story of Hope

After a devastating wildfire, a Pacific Palisades homeowner donated their fire-damaged house to Giving Center. By doing so, they alleviated financial burdens and contributed to the creation of much-needed housing for displaced families. This act of generosity not only brought them peace of mind but also sparked hope for others in the community.

Conclusion

If you own fire-damaged property in Pacific Palisades, consider donating it to Giving Center. This decision not only relieves you of the challenges of ownership but also provides significant tax benefits and supports community recovery. During times of loss, acts of generosity can help turn devastation into renewal. Reach out to Real Estate with Causes today to explore how your donation can make a lasting difference.

Home / House

Donations

Donate historic property, fixer uppers, estates, mansions, cabins, log homes, second homes or vacant houses.

Land / Acreage

Donations

Donate recreation, investment property, hunting land, timberland, land homesites or any vacant land.

Land Contract

Donations

Land Contract Donations – Donate Land Contracts Charity Donation Tax Benefits

Farm Land

Donations

Donate Farmland.. Vineyard, orchard, dairy farm, plantations, untouched acreage to fish farms.

Commercial Property

Donations

Donate Retail space, office space, gas station or any type of Commercial Property you own.

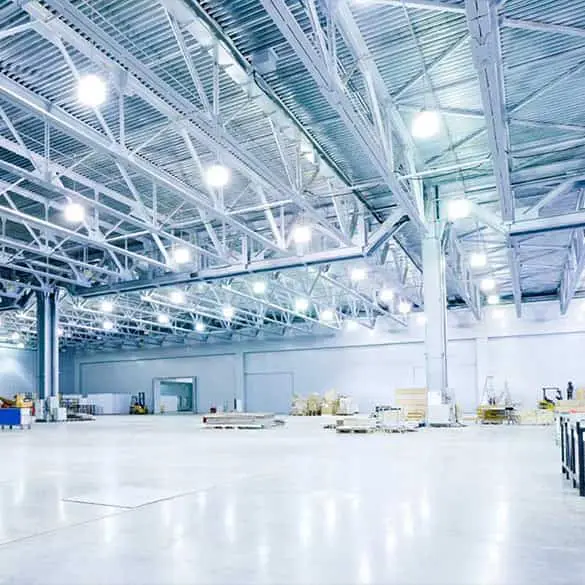

Industrial Property

Donations

Donate industrial property to charity. Donate a factory or warehouse to large shopping or distribution centers.

Rental Property

Donations

Donate rental property such as houses, condos, townhomes, duplexes, lofts or vacation residences worldwide.

Life Estates

Annuity

A life estate / charitable gift annuity donation can provide you and another beneficiary with lifetime income.